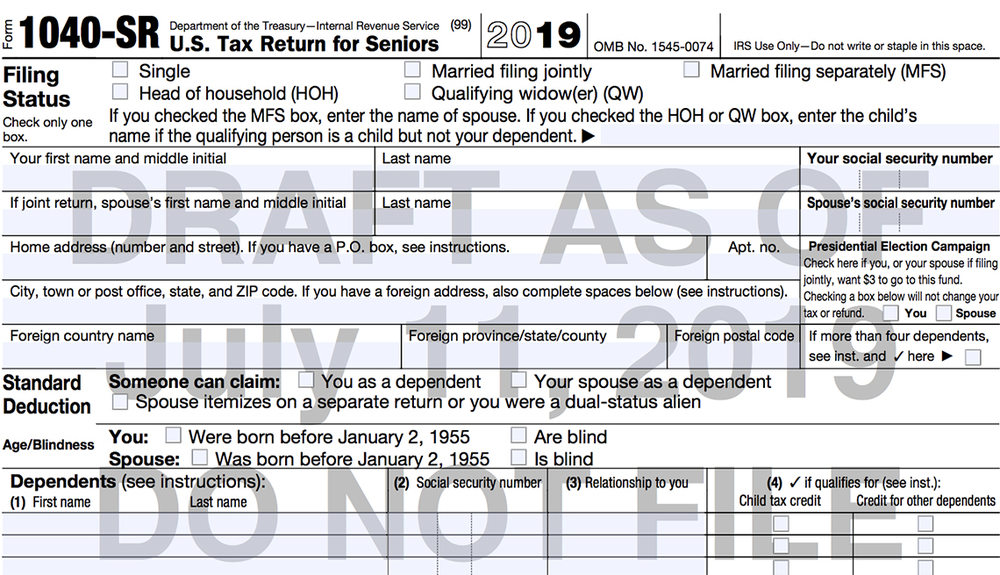

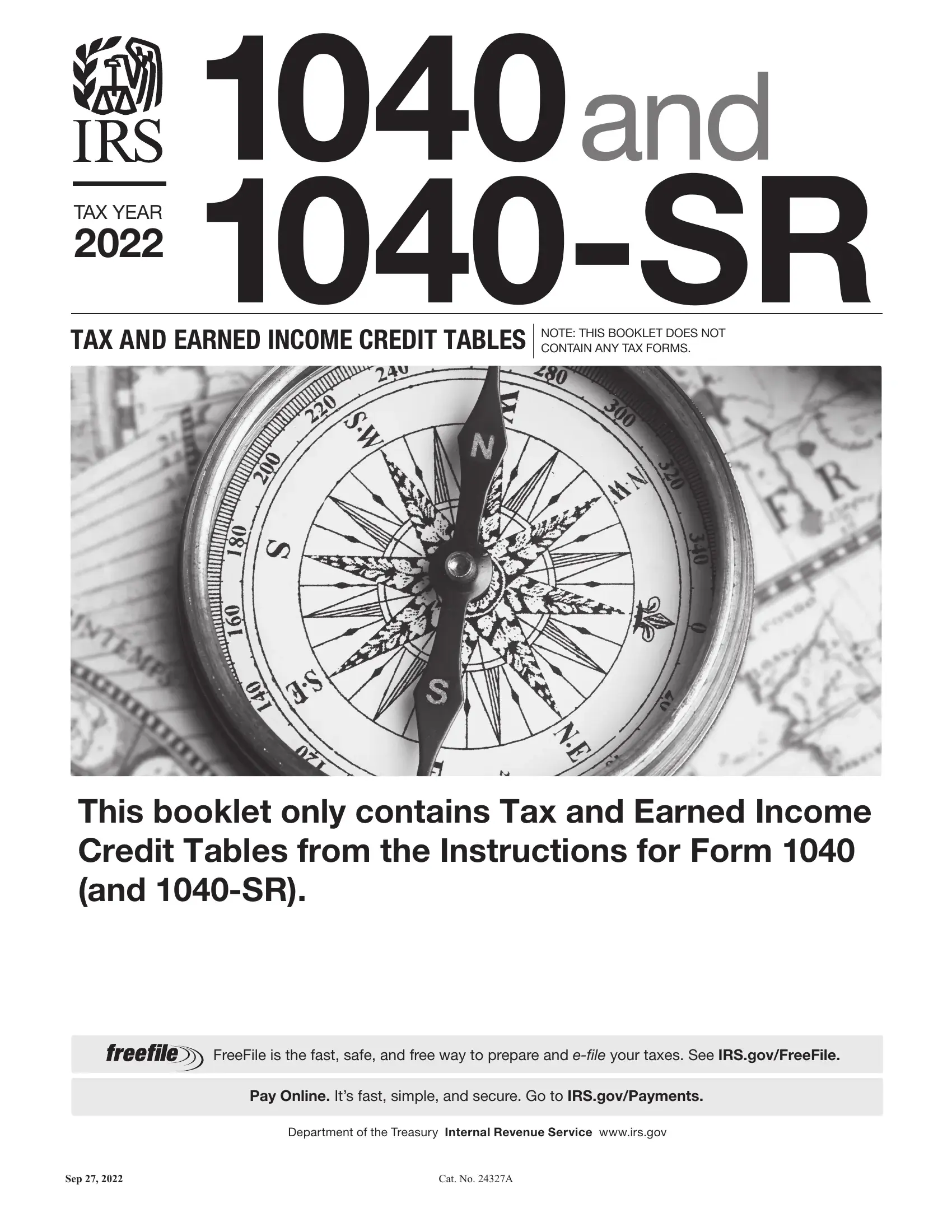

Irs Form 1040-Sr Instructions 2024

Irs Form 1040-Sr Instructions 2024. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. If you are searching for federal tax forms from previous years, look them up by form number or year.

Single taxpayers who are at least age 65 by the last day of 2023 can add $1,950 to their standard deduction when they file their. The rule, which is part of the infrastructure investments and jobs act of 2021, was slated to go into effect on january 1, 2024 but has been paused pending further.

$3,000 Per Qualifying Individual If You Are.

Fact checked by hilarey gould.

Calculate Tax On Form 1040, Line 16.

Single taxpayers who are at least age 65 by the last day of 2023 can add $1,950 to their standard deduction when they file their.

April 15 Is Also The Deadline For Your Second Installment Of Your 2024 Estimated Tax.

Images References :

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png) Source: rsuqtxrmtg.blogspot.com

Source: rsuqtxrmtg.blogspot.com

Irs 1040 Form Example Schedule C Form 1040 2019 1040 Form Printable, Income (line 1 through line 15) tax and credits (line 16 through line 24) payments (line 25 through line 33) refund (line 34 through line 36) amount you owe (line 37 through. You had over $1,500 of taxable interest or ordinary dividends.

Source: printableformsfree.com

Source: printableformsfree.com

Co Payment Application For Seniors Fillable Form Printable Forms Free, Filing the 1040 tax form online. This form notifies the irs about the missing refund and initiates a 'trace' on your refund.

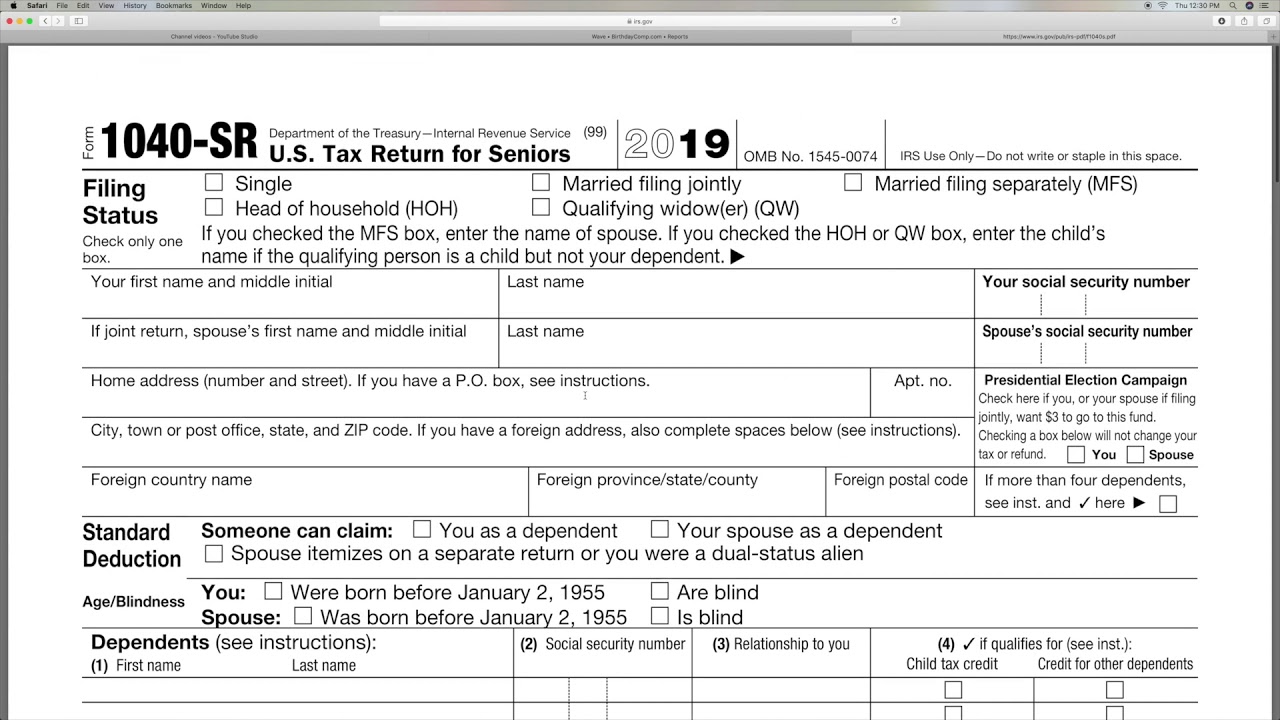

Source: www.youtube.com

Source: www.youtube.com

How to find Form 1040 SR Individual Senior Tax return online YouTube, Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. The very first 1040 tax form.

Source: templates.ula.edu.pe

Source: templates.ula.edu.pe

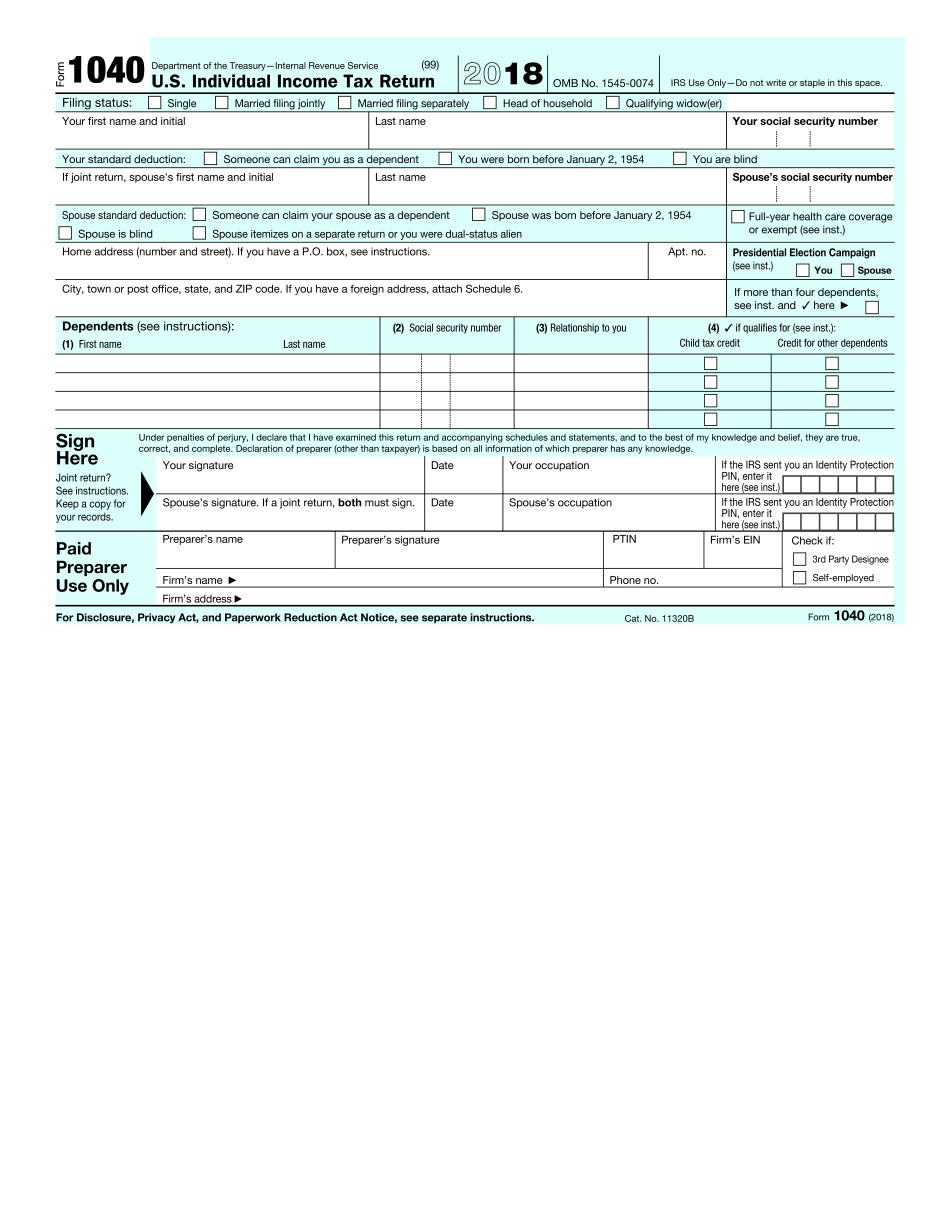

Free Printable Irs Tax Forms Free Printable Templates, Individual tax return form 1040 instructions; Income (line 1 through line 15) tax and credits (line 16 through line 24) payments (line 25 through line 33) refund (line 34 through line 36) amount you owe (line 37 through.

Source: www.bank2home.com

Source: www.bank2home.com

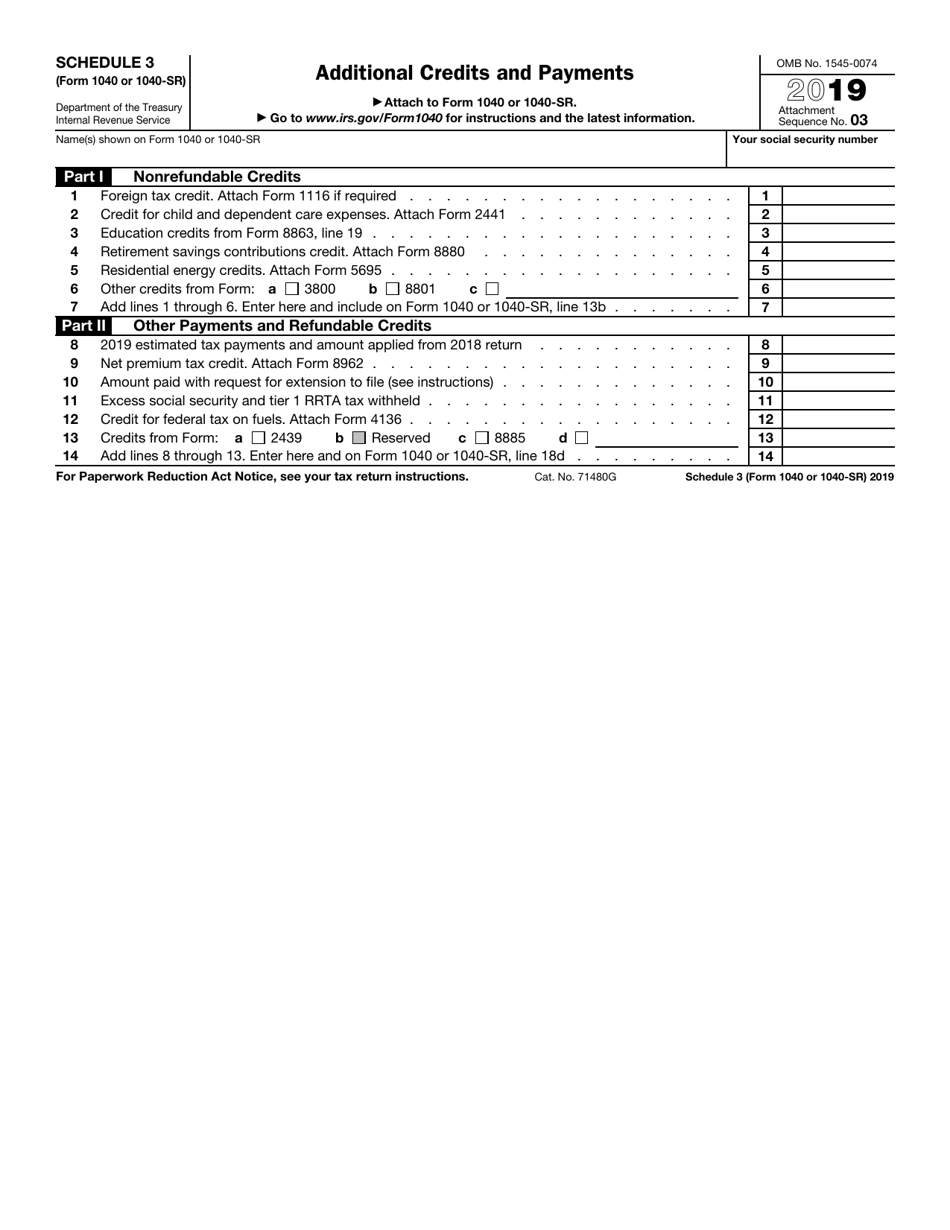

Irs Form 1040 Schedule 1 Download Fillable Pdf Or Fill 1040 Form, If you are 65 or older and blind, the extra standard deduction is: This is the main form for a tax return that gets filed with the irs when you are a u.s.

Source: www.thegoodlifesv.com

Source: www.thegoodlifesv.com

IRS Creates New 1040SR Tax Return for Seniors The Good Life, Aug 04, 2023, 2:47 am et. If you are 65 or older and blind, the extra standard deduction is:

Source: 1040logic.com

Source: 1040logic.com

IRS 1040 2024 Form Printable Blank PDF Online, $3,000 per qualifying individual if you are. Filing the 1040 tax form online.

Source: www.taxuni.com

Source: www.taxuni.com

1040 Tax Form Instructions 2020 2021 1040 Forms, Individual tax return form 1040 instructions; Use schedule b (form 1040) if any of the following applies.

Source: 1044form.com

Source: 1044form.com

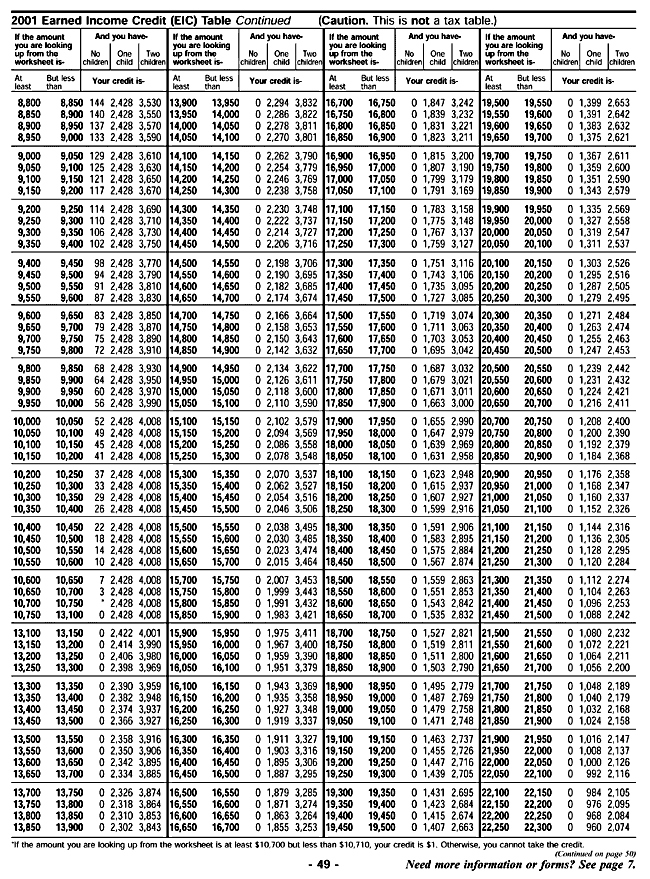

2014 Tax Table For Form 1040 Amulette 1040 Form Printable, You received interest from a seller. This is the group that our article is focused on.

Source: formspal.com

Source: formspal.com

Irs Tax Table Form ≡ Fill Out Printable PDF Forms Online, Filing the 1040 tax form online. Standard deduction for seniors over 65.

Fact Checked By Hilarey Gould.

Single taxpayers who are at least age 65 by the last day of 2023 can add $1,950 to their standard deduction when they file their.

Individual Tax Return Form 1040 Instructions;

If you are 65 or older and blind, the extra standard deduction is: