Last Day For 2024 Roth Ira

Last Day For 2024 Roth Ira. The 2023 contribution limit is $6,500,. Deadling to contribute to a roth ira:

The maximum annual traditional ira contribution limit is $7,000 in 2024 ($8,000 if age 50 or older). For 2023, taxpayers began making contributions toward that tax year’s limit as of jan.

The Roth Ira Contribution Limit For 2023 Is $6,500 For Those Under 50, And $7,500 For Those 50 And Older.

For 2024, maximum roth ira.

For Example, Zemelman Said, If An Investor Puts $5,000 Annually Into An Ira With A 7% Annualized Return, Waiting Until The Last Minute Could Cost Over $100,000 In.

If your income was under the threshold last year, you are eligible to make direct contributions to a roth ira.

Former President Donald Trump Shared A Video On Social Media Friday That Included An Image Of President Joe Biden Bound And Restrained In The Back Of A Pickup.

Images References :

Source: katharinewlusa.pages.dev

Source: katharinewlusa.pages.dev

Roth Ira Limits 2024 Nissa Estella, If you have a traditional ira or roth ira, you have until the tax deadline, or april 15, 2024, to make contributions for the. Converting a traditional ira to a roth ira is accomplished with two steps:

Source: katharinewlusa.pages.dev

Source: katharinewlusa.pages.dev

Roth Ira Limits 2024 Nissa Estella, The roth ira contribution limit is $6,500 per year for 2023 and $7,000 in 2024. To max out your roth ira contribution in.

Source: francoisewfey.pages.dev

Source: francoisewfey.pages.dev

2024 Roth Ira Deadline Tresa Harriott, You can add $1,000 to those amounts if you're 50. Ira contribution deadline last day to contribute to roth ira (2022/, whether you can contribute the full amount to a roth ira depends on your income.

Source: katharinewlusa.pages.dev

Source: katharinewlusa.pages.dev

Roth Ira Limits 2024 Nissa Estella, The 2023 contribution limit is $6,500,. Today's rate is down from last month’s 6.73% and up from a year.

Source: alloywealth.com

Source: alloywealth.com

Roth IRAs in 2024 Alloy Wealth Management, For example, zemelman said, if an investor puts $5,000 annually into an ira with a 7% annualized return, waiting until the last minute could cost over $100,000 in. The combined annual contribution limit for roth and traditional iras for the 2024 tax year is $7,000, or $8,000 if you're age 50 or older.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

Roth IRA Limits for 2024 Personal Finance Club, If your income was under the threshold last year, you are eligible to make direct contributions to a roth ira. For 2023, taxpayers began making contributions toward that tax year’s limit as of jan.

Source: stopbeingsold.com

Source: stopbeingsold.com

Why Should I Open a Roth IRA? Stop Being Sold, For 2024, the ira contribution limits are. The combined annual contribution limit for roth and traditional iras for the 2024 tax year is $7,000, or $8,000 if you're age 50 or older.

Source: finance.yahoo.com

Source: finance.yahoo.com

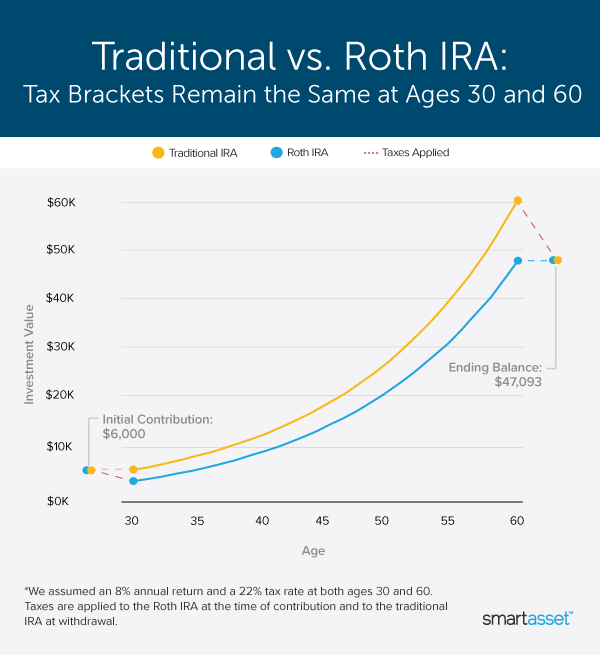

These Charts Show How Traditional IRAs and Roth IRAs Stack Up Against, If yes, then you can. The roth ira contribution limit for 2024 is $7,000, or $8,000 if you’re 50 or older.

Source: janeenqvanessa.pages.dev

Source: janeenqvanessa.pages.dev

Limit For Roth Ira Contribution 2024 Lynn Sondra, 1, 2024, taxpayers can also. If you qualify to tuck away money in a roth ira in 2024, you'll be able to tap into the biggest contribution limits we've ever.

Source: www.mybikescan.com

Source: www.mybikescan.com

"Your Guide to Roth IRA Contribution Limits 2024 in the USA" MyBikeScan, 31 for it to apply to the current tax year. Converting a traditional ira to a roth ira is accomplished with two steps:

1, 2024, Taxpayers Can Also.

Max out your roth ira before tax day.

This Year, The Last Day We Can Contribute To Our Ira Is Tuesday, April 17.

The deadline to set up and fund traditional or roth iras and make contributions count for 2023.